Goooood Afternoon!

Happy March everybody! The warm weather is getting closer and closer. When I hear March, I instantly think Spring Training and the fact that the MLB is finally back.

Did you all hear about the new pitch clock changes for this year? In an effort to speed up the (too boring and long) games, pitchers now have 15 seconds between pitches to start their motion for the next pitch.

I am so excited about what this can mean for baseball and also grateful for the incredible videos coming out of Spring Training as the players learn the new rules. This is exactly what the MLB needed.

Recently, here at The Crossover we have been pretty focused on the public markets as we were in the heat of earnings season. Next week, we will be venturing back into venture land with an expert interview discussing Wiz's $300M Series D and what this means for the cyber security landscape.

Also, make sure to check out my thoughts below in the Media Minute section where I break down Paramount rejecting a $3B+ offer for Showtime.

Showtime!

Key Stories

1. FIGS Struggles Continue

When the Crossover Portfolio launched, $FIGS was our foundational investment and checked all of the boxes that we here at The Crossover value: Significant top line growth partnered with positive FCF, a significant competitive moat and high brand affinity from customers, and phenomenal management.

How pretty were the financials of $FIGS? Check out this chart out I shared in the original write up I did on the company in July '22:

Very high gross margins, +70% Explosive revenue growth, represented by 59.5% YoY growthActually generating (serious) Free Cash Flow

Also, FIGS had a strong balance sheet represented by ending 2021 with $197M in cash and $0 in debt. All of this, and the company was trading at less than a $1.5B.

However, just 4 months later, the thesis on the investment broke as supply chain issues significantly disrupted the company's business model and it became clear that COVID and stimulus checks were a big boost to sales, inventories were rising, top line growth went away, and free cash flow negative quarters began.

I was out at a big loss and The Crossover Portfolio today would look a whole lot prettier without the investment. But we did make it and we live and learn.

Even as the stock rebounded significantly to start the year (up nearly 30% and 55% from lows) our thesis of a broken thesis (I think that makes sense!) was confirmed on Thursday's earnings call when the company shared guidance for 2023 of single digit revenue growth" and 11-12% EBITDA margin.

Not good for a company that has long forecasted serious top line growth with desired 20% margins. The company remains confident in their ability to double revenues to $1B over the coming years (from $505M currently), and I think they will based off of the international growth prospects and ability to build out ancillary products outside of the core FIGS scrubs.

It sounds like the company sees a nice re-aceleration coming in 2024. However, 2024 for FIGS, so far away.

The truth of the matter is, this is a good company, with excellent management in tough times. I do think this investment at these levels will be a solid one for investors in the long run, however, I am much more excited about other opportunities in the market, but will continue to watch this one closely.

2. Is Paramount Selling Showtime?

On Tuesday, the WSJ reported that David Nevins, former Showtime top executive, tried to acquire Showtime for $3B+ from Paramount in a deal backed by PE firm General Atlantic.

Here were some key points around the rumors:

Paramount declined the offer with CEO Bob Bakish saying that "there is enormous value to unlock with the integration of Showtime and Paramount+" and that $PARA's operating plan would create more value for shareholders.

This is not the first time that Showtime has been in the rumor mill as two years ago Mark Greenberg, another seasoned former Showtime exec, tried to buy the premium entertainment network for $6B backed by Blackstone. Last year, Lionsgate also approached Paramount about merging Showtime with Starz.

I don't know if there is anyone on Wall St. that would disagree that Paramount's sum of parts valuation is 2-3x its current equity value of ~$14B. Heck, spinning off their legacy broadcasts and cable networks that rip off ~$5.5B in operating income would likely sell for significantly more than the current market cap in a deal with private equity.

Then when you think that Paramount Pictures could demand ~$10B, the value of Simon & Schuster of ~$2B+, PlutoTV & Paramount+, the real estate, and so much more, the thesis is clear of why I have been a long term bull with Paramount.

The fact that just a sale of Showtime on its own @ $3.5B would represent 25% of the company's current equity value, further confirms the sum of parts thesis. However, what Wall St. does also know is that Shari Redstone is unlikely to sell for the next couple of years and they are skeptical of $PARA's ability to execute on their gameplan - hence the discount to intrinsic value.

As a true investor in Paramount, the idea of a Showtime sale and a massive buyback causing shorts to get flashbacks to the Bill Hwang era, would have been great. However, the long term potential of a successfully executed push into streaming by Bakish and co. could lead to even greater rewards - a gameplan that they are executing on beautifully.

In a streaming landscape where a deep library of unique IP matters critically, Showtime with YellowJackets, Billions, Homeland, Your Honor, Shameless, Dexter, and more, is extraordinarily valuable. Especially, as $PARA plans to collapse Showtime into Paramount+, the ability to drive one core product has the potential to create in my eyes a true streaming wars contender.

Also, from a strictly financial perspective valuing the Showtime asset, I think that this was a real low ball of an offer. Steven Cahill, analyst at Wells Fargo, estimated that Showtime does $2B in revenue on a $1B content budget. He assumes that there is an additional 20% of SG&A and marketing costs leaving the service with $600M in EBITDA.

This would mean that Nevins offer was just over 5x EBITDA - which I find to be a real low ball due to the thematics in streaming, Showtime's quality, and consumers insatiable appetite for great content.

I also don't think that Nevins would have went in that low for Showtime, which makes me think that the fundamentals of Showtime's business are not as strong as Cahill projects.

I also wanted to point out that if Nevins were to have acquired Showtime, I feel that this would have been the first move of two. I project Nevins would have went after the consistently shopped Starz from Lionsgate for a couple billion.

Nevins and Co. would have looked to build the premium streaming service, built it up for 3-5 years before selling it to a larger player. The gameplan was smart and clear, however, it looks like Nevins and General Atlantic did not want to pay up.

Simply put: In regards to Showtime and paramount, It is on PARA's management to unlock the value of this company. They have their strategy, it is working, and they have committed to it. At the same time, they still have so much to prove.

The Crossover Archive

Toast & BVP, Penn, Netflix,

Missed a recent edition? That's okay! Now you can just click on these links below to catch up on what you missed!

02/07 - Penn Entertainment: A Solid Q4

Chart of the Day

Splunk = FCF Machine

Splunk released their Q4 earnings earlier this week, and I continue to be bullish on the company. Why? As you can see from the title, they are quickly becoming a FCF machine

Splunk is projecting $775-$795M in FCF in 2024 (which is their next FY) representing 81%-86% growth YoY and ARR of $4.125B - $4.175B representing 12-13% growth YoY

From a valuation perspective, at a ~$17B market cap, the company is trading ~21x FCF and 4x ARR

Want to read more of my thoughts on $SPLK? Make sure to check out my analysis on the company from December

Portfolio

The Crossover Portfolio

Note: The Crossover Portfolio is a mock portfolio of how I would be investing and not with real money. All trades are shared publicly @ The Crossover Twitter as they are recognized.

Moves: Zero moves. Just how we like it. Again!

The Zone: The Zone announced that they have become the official Mental Wellness Partner of The Big East. What a big accomplishment for Ivan & Co.

RocketVR: RocketVR was featured in the Boston Business Journal

$SPLK: Splunk released their Q4 earnings and they were rock solid. Click here for link to their investor presentation from the quarter

$ESTC: Elastic released their Q3 earnings and they were excellent!

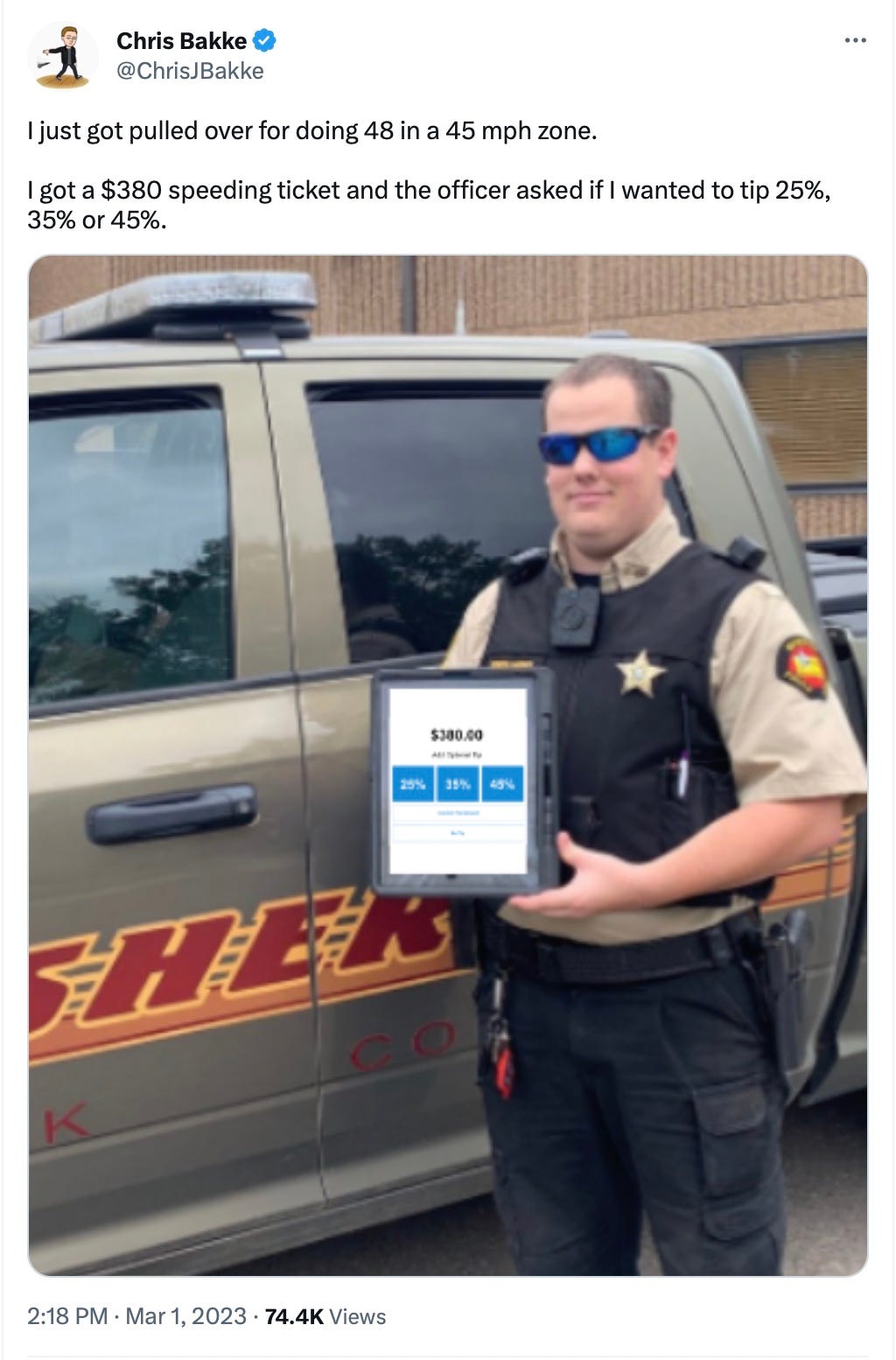

Meme of the Day

Golden Nuggets

The atmosphere at Charlotte FC's stadium looks incredible! The MLS continues to heat up

This Warren Buffett quote is flames

WeWork's market cap is now below the value of the golden parachute that Adam Neumann received. Crazy.

Lebron, Luka, and Mahomes in one pic. This is sweet.

Disclaimer: The Crossover Daily is not a professional financial service. All materials released from The Crossover Daily are for educational and entertainment purposes. The Crossover Daily is not a replacement for a professional's opinion. Contributors to The Crossover Daily might have positions in the equities in the The Crossover Portfolio or mentioned in the newsletter.