Goooood Evening!

I hope you all had a great weekend and especially enjoyed all the incredible television last night of 1923 and Last of Us. I am sad that 1923 is now done for the season, but at least we still have more Last of Us on the way.

Today, I will be sharing my analysis on Toast’s Q4 earnings. Let me know what you think, and if you like it, make sure to share it with a friend.

Showtime!

Deep Dive

1. Toast Q4 Earnings

Introduction

I never thought I would spend more time thinking about a mock portfolio than I do now with The Crossover Portfolio. What started off as a way to put some type of accountability behind my analysis has quickly become a lesson learning machine for me and something that I manage as I would a real money portfolio.

Why? Because one day I hope to make big money decisions with real money, and it is much better to learn these lessons through a mock portfolio than an actual one!

Ever since my first analysis on Toast, two things have been clear:

Toast is an incredible company

Toast is overvalued (in my eyes)

Ultimately, I decided to build a small position in The Crossover Portfolio where I would more than happily pick up some more if there was a dip and would benefit on the upside if the stock were to rise. The stock was overvalued, but not too overvalued where I did not think that a small position was warranted initially at $16.06.

As the new year began, to my surprise as well as so many in the markets, growth/tech stocks had a great start to the year and Toast was up over 45% YTD and our position ~60%. At a $12B+ valuation, ARR of $866M, profitability quarters away, and a macro environment I was skeptical of, I wanted to sell.

Even more so helping the part of that wanted to sell was the fact that there are other phenomenal growth companies that are growing nicely WHILE ALSO generating meaningful FCF like Digital Ocean and Elastic.

So. Why would I stick with Toast?

Some of my best investments over the past decade, as well as my dad’s who I have learned so much from, have been from smaller investments in great companies that you do not touch for years and years and just watch them compound.

With such a small position in Toast, this company fit the bill and even though I was uncomfortable with the valuation, I stuck with it and happy I did.

“But Alan. Toast is down 30% on earnings. How could you be happy you stuck with it?”

Great question. The answer is because I was happy with the fundamental approach, logic, and reasoning that I took to holding on and ultimately I feel that these principles will help me be a great investor in the long run – and in the long run, this decision will look smart.

Now with the stock down 30% since earnings, what am I doing with Toast? Are we loading up and buying the dip or sticking with what we got?

Let’s take a look and Toast’s Q4 and then share what we will do!

Earnings & Guidance

Here were the key financial metrics from Toast’s Q4 earnings compared to Wall Street’s expectations:

Revenue: $769M (actual) vs. $753M (estimates)

EPS: -$0.19 (actual) vs. -$0.5 (estimates)

The revenue in Q4 represented a nice beat of 50% YoY growth, but the -$0.19 loss represented a $99M loss and was a much bigger loss than analysts expectations.

In the quarter, the company also achieved some significant operational accomplishments including:

Growing ARR, the key financial figure with Toast to look at as we will break down later, to $901M (59% YoY growth)

Added ~5,000 new restaurant locations in Q4 alone taking total restaurants to ~79,000 (40% YoY growth)

Gross Payment Volume (sales through Toast platform) up to $25.5B (49% YoY)

These are serious numbers.

What is also exciting for Toast bulls is that even with all that company has accomplished, there is still a massive opportunity in front of it as there are over 860K restaurants domestically and 2M globally. In other words, Toast has just 9% of US restaurants on its platform.

What does Toast see 2023 looking like?

In Q1 ‘23 Toast projects around $745M to $775M in revenue (compared to analyst expectations of $751M). For FY ‘23, Toast expects revenue of $3.57B to $3.66B vs. analyst expectations of $3.62B. The company also guided an adj. EBITDA loss of -$10M to -$30M for ‘23 vs. analyst expectations of -$19M.

Revenue of $3.6B would represent 33% top line growth YoY and adj. EBITDA loss of -$20M would trim losses by just under $100M as the company had a ($115M) adj. EBITDA loss in ‘22.

Toast’s forward looking forecast does look solid, however, a big beat likely was needed to keep the momentum for Toast’s stock goin

Why ARR?

As we have discussed in the past, it is important to recognize that top line revenue should not be the core fundamental that Toast is analyzed off of, but rather ARR.

Why? Toast has 4 key revenue streams:

Subscription Services – Fees charged for customers to access SaaS like POS, kitchen display system, invoice management, digital ordering, etc.

Financial Technology Solutions - (Mostly) fees paid by Toast customers to facilitate the transactions on the platform. Includes a percentage of the total value of transactions processed as well as a small basic fixed fee.

Hardware Revenue - Revenue earned from the sale of of terminals, tablets, handhelds, and other Toast accessories

Professional Services - Services that Toast provide when new restaurants join platform or existing Toast customers add new products to their

Here is the financial breakdown of these respective revenue lines:

As you can see, a far majority of the company’s revenue comes from their FinTech solutions which has 21% margins. The real sexyness from the business is in the 65% margin SaaS services.

The losses in Hardware Revenue and Professional Services are sold at a significant loss as they are integral to launching and ultimately building towards the higher quality revenues.

Therefore, Toast highlights their ARR, which they consider to be the Subscription Services and FinTech Solutions.

ARR in the quarter grew to $901M which represents 59% YoY growth. This also means, after the 20% drop in share price that the company is trading at ~11x ARR.

Speaking of Subscription Services, Toast is showing great momentum in there ability to sell additional SaaS products to restaurants and take more and more of their wallet share.

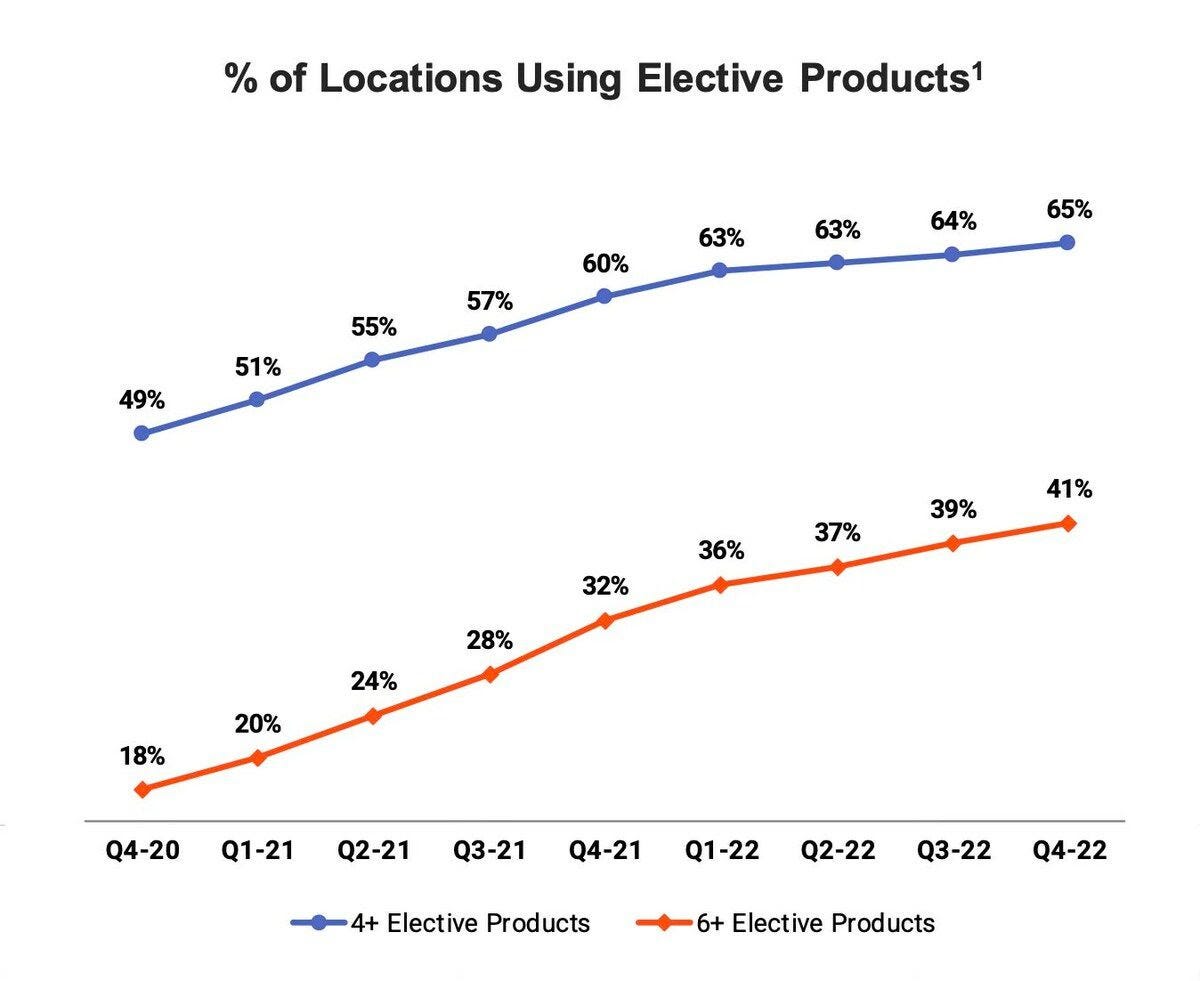

As you can see, 65% of Toast locations have more than 4 SaaS products, a 500 BPS increase year over year and 41% of locations have 6+ products, a 900 BPS increase YoY.

Toast Capital

In the Q4 earnings call, we also got a good update on Toast Capital. Toast Capital is a loan program through Toast where they offer restaurant loans ranging from $5k-$300K over three various terms: 90, 270, and 360 days.

What is really interesting about this opportunity is that Toast leverages the knowledge and data they have from the restaurants past data to underwrite, process, and manage risk. The loans are also serviced using a fixed percentage of daily sales, decreasing the risk of the loan significantly.

This provides a unique opportunity to Toast to create an additional source of revenue making money from marketing, underwriting, and servicing the loans. Toast does work with a regulated bank to manage and hold the loans making it a balance sheet light business model.

In Q4, Toast saw $24M in gross profit from Toast Capital alone. The company shared an example on the call of a Georgia steakhouse that used funding from Toast Capital to install powered curtains to enclose the outdoor patio adding 70 new seats for the winter. This helped the restaurant grow sales 20% YoY.

One final note: ~80% of Toast Capital customers have come bank for a second loan. There is serious flywheel potential here for Toast with Toast Capital.

The company has not shared any annual figures for Toast Capital in 2022, but as we go into 2023 it is a very interesting business line and development to monitor.

Alan's Angle

So... what do I think about Toast? Well, in some ways Toast has me burnt out! There is so much I love about the company, but even after a 20% drop, I don't think I find myself wanting to pickup the stock simply due to valuation reasons.

From one perspective, it feels as if Toast is just getting started and has displayed great ability to move clients to more and more of their products once they get them on the platform. Also, something like Toast Capital shows that the company has a lot up there sleeve of different ways to monetize the stronghold that they have on restaurants domestically.

I also am intrigued by the likelihood that additional revenue from this point forward will greatly out pace SG&A growth – in other words, the power of scale.

Yes. 11x ARR is not cheap, but is it really that expensive for a company growing clients and revenues at the velocity they are?

I didn't even touch on the companies recent acquisition of Delphi, drive thru-tech, and its recently announced Google integration!

The other perspective, and the one which I find myself aligning with more closely at the moment is that everything from above is true, but it just does not warrant additional investment from The Crossover Portfolio strictly due to valuation.

This past year, Toast had -159M in negative FCF. The company expects to be leaving 2023 at an adj. EBITDA profitaiblity level. Adjusted EBITDA, is very different than FCF positivity. Additionally, there other B2B SaaS companies that I feel have the opportunity to be generational like Elastic and Digital Ocean that are FCF positive, lowering risk significantly.

If this stock continues to get hit, I will be a buyer, however, at this point, I am doing my favorite thing when it comes to investing – nothing at all.

-Alan

The Crossover Archive

Toast & BVP, Penn, Netflix,

Missed a recent edition? That's okay! Now you can just click on these links below to catch up on what you missed!

02/07 - Penn Entertainment: A Solid Q4

Meme of the Day

Golden Nuggets

This shot from Joel Embiid was incredible. If only it counted.

I absolutely love the new MLB pitch clock rule. What do you think?

Loved this interview with Tom Cruise on Jimmy Kimmel

Disclaimer: The Crossover Daily is not a professional financial service. All materials released from The Crossover Daily are for educational and entertainment purposes. The Crossover Daily is not a replacement for a professional's opinion. Contributors to The Crossover Daily might have positions in the equities in the The Crossover Portfolio or mentioned in the newsletter.